My son spends a lot of time traveling with the Boy Scouts. At least once a month, I drop by the local ATM in order to grab money for gas, food, and other necessary items. When that's not happening, one of my three kids needs to see a doctor or make an unplanned last-minute purchase, for which I am requested to fund.

Until now, my options were to make frequent stops at the ATM or pull extra cash while paying for groceries. It works but it's not perfect.

If I had my way, I wish that I could quickly transfer money from my account into sub-accounts. Then, when the kids need money, they can pull out a debit card and make their purchases. This process would allow me to better control the family budget while remaining flexible for those times when they need money.

The Solution

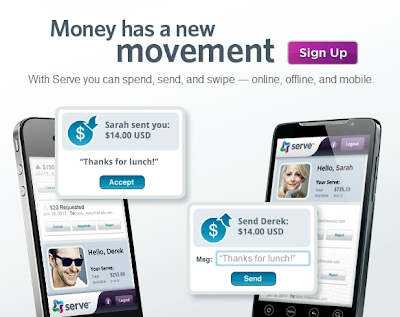

Thanks to American Express, I can have exactly what I wished for and more. The solution is called, Serve and it makes sending, receiving, and spending money easy to do. Did I mention it was FREE?

Through the web site and mobile app, I can load the account with money using my bank account, debit, and credit card. Once funded, it's a cinch to transfer resources from the main account to my kid's sub-accounts. From there, they can use a prepaid reloadable Serve card wherever American Express cards are accepted.

Other Uses

As I peruse the service offerings on their site, I thought about other ways to use Serve. Below are a few ideas.

- Sub-accounts for fraternity business - Committee chairs, or other organization representatives, may need to put down payments on facilities, purchase supplies for events, or take a trip on behalf of the organization. In these cases, a prepaid Serve Card would allow the Treasurer to put money on the card and not worry about individuals spending more than what is allocated.

- Raise money for a podcast - Accepting donations in support of a podcast is made easier when there is a widget on the page. Listeners can trust the American Express name for its dedication to security.

- Raise money for a worthy cause - Use a widget on your web site to accept donations for scholarships, cancer research, feeding the hungry, or any number of worthy causes.

- Allowances - With kids, having an allowance is one way to offer financial resources while teaching proper money management.

The Fine Print

I know what you're thinking, because I was thinking it, too. All of that sounds great, but how much does it cost? What's the catch? How does Serve compare to PayPal? In this section, I'll attempt to answer a few of those questions.

- Adding money - If adding money from a credit or debit card, adding money is instantaneous. However, if you add money from a bank account, it could take up to 5 business days.

- Sending and receiving money - To send and receive money, both parties must have a Serve account. Once in place, you can send money using their email address.

- Subaccounts - If you're going to use the subaccount with children, please note that you only get four subaccounts and kids must be at least 13 years of age.

- Fees and limits - For the most part, everything is free. You can transfer funds and purchase items without cost. However, the following actions may incur a fee:

- ATM withdrawl - The first withdrawl each month is FREE, but after that it's $2.00 each time. This doesn't take into account any fees applied by the bank.

- Funding the Serve account with a credit card - Using a credit card to add money will incur a 2.9% of amount transferred + $0.30 transfer fee.

- Subaccounts - There is a one-time fee of $2.95 to setup a subaccount.

- Funding limits - There is a limit of $100 per day from credit and debit cards and a $1,000 limit per day from a bank. Total funding per month is $2,500.

- Serve vs. Paypal - For the most part, the two offerings are pretty close. However, there are a few differences. See below:

- Pay by check - Paypal allows users to scan checks using a mobile device and then deposit that money into an account. Serve does not.

- Rewards - Serve Cards do not offer rewards but Paypal does.

- Credit card backing - Serve is backed by American Express and Paypal by MasterCard.

- Subaccounts - Paypal offers a subaccount for kids aged 13-18 but Serve offers a subaccount for anyone over the age of 13.

As a long time user of Paypal, although not extremely active, I like what Serve provides. Most importantly the subaccount idea.

As a father of three and president of my local fraternity chapter, the current offerings could serve quite beneficial to our needs.

Please note that in writing this article, I am not yet an experienced user of either Paypal or Serve. Given more time, I'm sure I could render a more personal story about the pros and cons of each. Until then, I look forward to hearing from you and your stories. Let me know what you think in the comment section below.

Special Thanks to Danielle Baldwin for bringing this service to my attention.

Special Thanks to Danielle Baldwin for bringing this service to my attention.

0 comments:

Post a Comment